The various financing options available for CCUS projects in Canada

CCUS and its significance in Canada

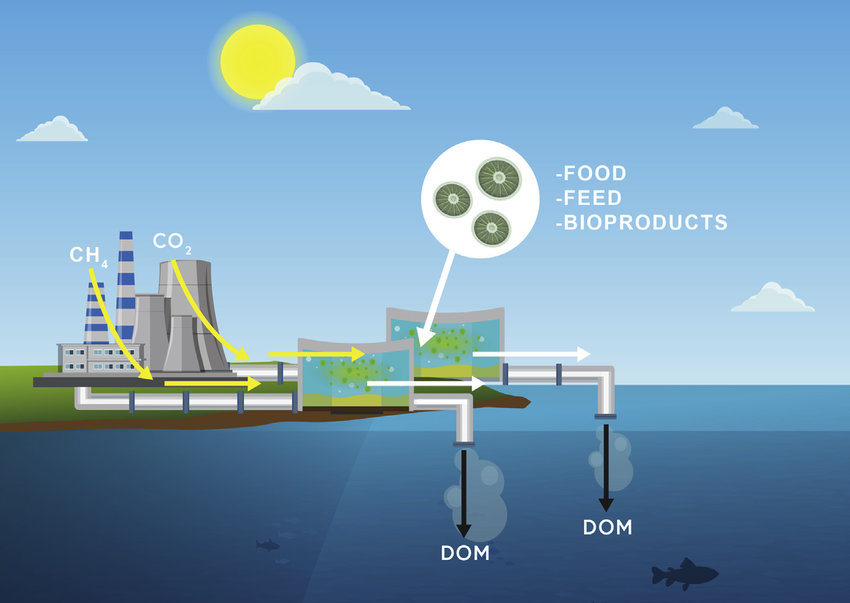

Carbon capture, utilization, and storage (CCUS) technology plays a significant role in mitigating the impact of climate change by capturing carbon dioxide emissions from industrial processes and storing them in geological formations. As one of the largest emitters of greenhouse gases in the world, Canada has set an ambitious target to achieve net-zero emissions by 2050. To achieve this target, Canada needs to invest in CCUS projects that can reduce carbon emissions from various industrial sectors. However, financing such projects is not an easy task. This article explores the various financing options available for CCUS projects in Canada.

The financial challenges of CCUS projects in Canada

CCUS projects are capital-intensive and require significant investments. The high upfront cost of such projects makes it challenging for companies to fund them without external support. Moreover, the lack of a clear regulatory framework and a carbon pricing mechanism in Canada further exacerbates the financial challenges of CCUS projects. As a result, there is a need for innovative financing options that can help companies to fund CCUS projects and make them economically viable.

Government funding options for CCUS projects

The Canadian government has recognized the importance of CCUS technology and has introduced several funding options to support CCUS projects. These include the Low Carbon Economy Fund, the Strategic Innovation Fund, and the Clean Growth Program. These programs provide funding support for CCUS research, development, and demonstration projects. Additionally, the government has announced a $750 million Emissions Reduction Fund to support large-scale CCUS projects.

Carbon capture tax credits and incentives

Apart from government funding, CCUS projects can also benefit from tax credits and incentives. The Canadian government offers a range of tax incentives for companies that invest in CCUS projects, such as accelerated depreciation of capital assets and investment tax credits. Moreover, some provinces offer additional incentives, such as property tax exemptions and sales tax exemptions for CCUS equipment.

Private sector investment opportunities for CCUS projects

The private sector can also play a critical role in financing CCUS projects. Private sector investment can come in the form of equity investments or debt financing. In recent years, several private equity firms and venture capitalists have invested in CCUS projects. Additionally, banks and financial institutions have started offering green bonds and other financing options for CCUS projects.

Project financing and capital raising for CCUS ventures

Project financing and capital raising are important options for CCUS ventures. Project financing involves securing debt financing from banks or other financial institutions for a specific project. Capital raising, on the other hand, involves raising equity financing from investors. Both options require a solid business plan and a detailed financial model. However, project financing is more common for CCUS projects as they require significant upfront investment.

Crowdfunding for CCUS initiatives in Canada

Crowdfunding is a relatively new financing option for CCUS initiatives in Canada. Crowdfunding involves raising small amounts of money from a large number of people. It can be an effective way to raise awareness and funds for CCUS projects. However, it requires significant effort and resources to create a successful crowdfunding campaign.

A bright future for CCUS financing in Canada

CCUS technology has the potential to play a significant role in mitigating climate change. To achieve Canada’s net-zero emissions target, there is a need for significant investments in CCUS projects. Fortunately, there are several financing options available, ranging from government funding to private sector investments and project financing. As the global focus on reducing carbon emissions intensifies, it is expected that more financing options will become available for CCUS projects, making them more economically viable.